So you have a problem of staying on top of failed rebill payments falling through the cracks.

You’re not the only one – it’s an unfortunate and frustrating part of being an online business owner. But let’s work on making your life a little bit easier and set yourself up for success with a system to manage them, so you don’t find out 5 months after the fact!

You’ll want to create a tracking system in your favorite project management tool.

In this blog post, I’ll be walking you through my preferred tech stack options for this process: ClickUp, ThriveCart, and Zapier. But of course you’re welcome to adjust it to your own preferred tech platforms.

What is a ‘Failed Rebill’?

A ‘failed rebill’ is a type of transaction that happens when you’re payment collecting system is supposed to charge a card, but it fails to process payment.

There’s a couple of reasons this could happen, including:

- The Credit Card information has changed since they originally purchased + needs to be updated

- There’s insufficient funds in the buyers bank account to process the payment.

This is an easy detail that can get lost in your business that can lead to a very serious problem – you not receiving your hard earned money! So let’s get you set up with this new system!

What Kind of Products Need a Failed Rebill Tracking System

You’ll need this if you have any of the following types of products for sale in your business:

- A membership

- Any product with a payment plan

Basically any scenario you’re asking to charge someone’s card multiple times.

Managing this can be a pitfall for online business owners if you don’t have the correct systems in place to track it. But luckily, since you’re here – that won’t be you 😉

What You’ll Need to Track Failed Rebill Transactions.

We’ll be using the following tech platforms to implement this system:

- ClickUp (my go-to online business solution)

- Zapier (another ops essential)

- Whatever your payment collection/checkout cart system is (for the purpose of this blog post, I will use ThriveCart because that’s what I use and recommend!)

While these are the platforms that I recommend, you’re welcome to adjust this to the needs of your own tech preferences 🙂

How to Create a Tracking System for Failed Rebills

Step One: Identify the Products You Need This For

Let’s start of simple. This may be as simple as deciding “I need this for all of them!” and then you’re done.

But you could potentially want to set this up differently depending on how your product suite is structured, so give that some thought, and maybe read through this post to see if you wanted to adjust to your business accordingly.

Identifying them could be as simple as making a list on pen and paper (or spreadsheet) if your answer is not “all of them.”

Step Two: Create a list in your ClickUp Account Titled ‘Failed Rebills’

This is the tracker we’ll use to make sure a failed rebill payment has been resolved or if it needs following up on.

Here’s what I recommend the list looking like:

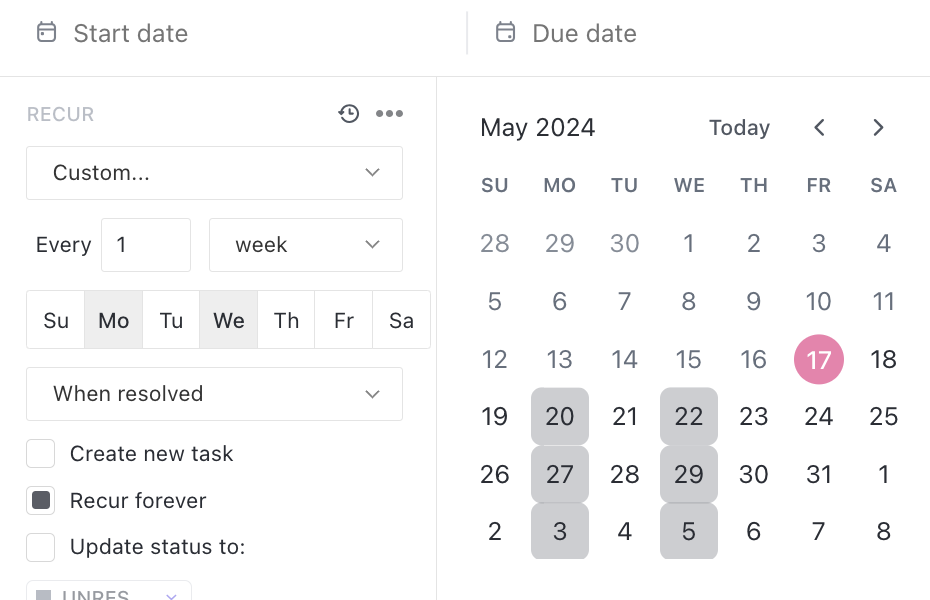

First, label the view ‘UNRESOLVED’ (see picture for reference). You’ll want a list with the following statuses:

- Unresolved

- (Optional) Needs Following Up

- Resolved

If you’re on a paid plan of ClickUp, create 2 custom fields and add them to this view:

- Client Name

If you’re on the free plan of ClickUp, which has a limited amount of uses of Custom Fields, don’t worry about making those custom fields. They’re not required to make this work and it’s not something worth upgrading your ClickUp account for.

If you want to be ridiculous like me when it comes to formatting, I would also hide the following columns from your views:

- Assignee

- Due Date

- Priority

Once you have this view looking the way you want it, duplicate that view and relabel it to be ‘RESOLVED’ – then adjust the filters to be only the Resolved’ Status.

Step Three: Create a Zap that Connects your Payment Processor to ClickUp.

Now we’re going to work out of Zapier. Go ahead and create a new zap, and label it ‘Failed Rebills to ClickUp.’

We’re going to connect whatever tool you use for Payment Processing or as your Checkout Cart and add those failed rebills to your ClickUp account.

Like I said earlier, since I use ThriveCart, I’ll use that for this example. You can of course modify it to your own specific platform that you use.

The first step of the Zap will be triggered by ‘Recurring Payment Failed.’ Connect your ThriveCart account and go ahead and keep the settings in the ‘Trigger’ step the same. Technically, you could set the product status filter to ‘Only trigger in live mode’ but it’s not really necessary.

Then, the next step of the Zap is to create a task in ClickUp. Here is how I suggest organizing these in your ClickUp account:

Operations Space >> No Folder >> Failed Rebills

From there, there’s a couple of ways you could do this depending on what ClickUp plan you have:

OPTION #1 (Free ClickUp Plan): For the task name, you’ll want to pull in the name of the product, and the customers first and last name. In the task description, I recommend putting in the email of the person. You’ll then want to set the due date to Today, and the assignee to whoever manages your failed rebills (you, your VA, etc.)

OPTION #2 (Unlimited ClickUp Plan or higher): For the task name, you can just put the product name. Then, you can create a separate custom field for the email + client name, where you’ll pull in those respective pieces of information. I would still pull in the email to the task description, and the due date be today and the assignee to whomever manages your failed rebills.

Once you’ve set up the Zap, don’t forget to test it to make sure it runs properly and creates the task to your ClickUp!

Step Four: Create a Recurring Task to Check The Failed Rebill Tracker

Next, in the list ‘INTERNAL TO DO’ in your ‘OPERATIONS’ Space, I recommend creating a recurring task to check for failed rebills.

As for the frequency of the recurring task, I recommend doing every Monday and Wednesday.

Title the task ‘Check Failed Rebills’ and in the task description add the link to the ‘FAILED REBILL’ list. You’ll want to add any platform specific notes to the task description too that may be relevant.

With ThriveCart as an example, when a failed rebill occurs, it will reattempt payment a total of 3 times before the payment is cancelled. Typically how I handle it is if it’s the first failed payment, I’ll double check they received the email to update their payment information. If it’s the 2nd, I’ll manually send them an email checking in. And on the 3rd, I’ll send another.

In the task description, I recommend leaving notes of how you handle each type of failed rebill, and you can even leave an email template(s) for you to easily copy and paste when you need them.

And there you go! That’s how to manage your failed rebills in your online business using ClickUp.

Hopefully this will help you gain control over this piece of admin work, and make it easier for your team to manage.